Ivan Petkov

We design business and personal web sites including other things.

I am an Assistant Professor of Economics at Northeastern University, Department of Economics

My work focuses on: Local Financial Markets, Banking, Economic Growth, Local Labor Markets, Cultural Economics, Political Economy, Natural Disasters, and Resilience

Publications:

Most Recent Publications

Abstract: I examine the role of bank’s distance to the borrower and the proximity of other lenders for the transmission of financial shocks across the bank network. I use a novel dataset of small business lending based on information from the Community Reinvestment Act, which measures lending at census tracts within each county and yields rich variation in the bank-borrower and borrower-competitor distance. I document that small banks with increased liquidity from proximity to local oil booms, originate more loans to firms far from these booms, and lenders with above-average geographic exposure to residential booms reduce lending in census tracts with stable house prices. Bank-borrower distance is important for credit expansions, with closer firms receiving more credit, but not for contractions. Proximity of competitors plays a key role: consistent with theoretical predictions, both credit expansions and contractions dis- proportionately affect markets where the bank faces higher competition.

General Discussion: With novel data of within county lending, this paper is the first to confirm that exposure to oil and residential booms impacts supply of credit to small businesses in other markets. I go beyond identifying the average change in credit and examine how it differs across markets with varying levels of information frictions and competition.

I document that proximity of competitors affects the transmission of financial shocks: lending in markets where the bank faces higher competition is particularly sensitive to its financial state, both in the cases of increase and decrease in credit supply.

My results suggest that branches do not simply integrate local markets with limited arm’s length financing because their specialized information acquisition limits contracting frictions. They also play an important role in competition. Given additional liquidity, lenders contest the informational advantage of competitors and increase lending where they are not as good at acquiring specialized information.

Small Business Lending and the Bank-Branch Network

Journal of Financial Stability (forthcoming)

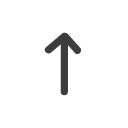

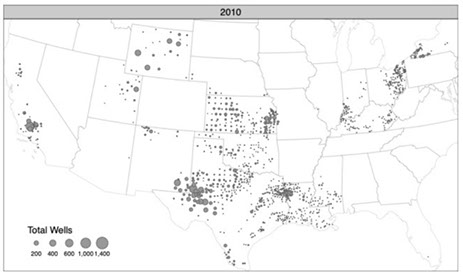

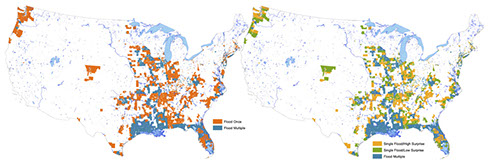

The pictures above plot the main geographical drivers which serve as the basis for this study. The top showcases the wide-spread drilling for oil within the US, while the bottom shows the diverse house-market experience right before the Great Recession. Both of these created incentives for local lenders to adjust their lending portfolios: proximity to fracking boosted liquidity and motivated banks to reach farther, while proximity to real estate booms made lending in other places less profitable.

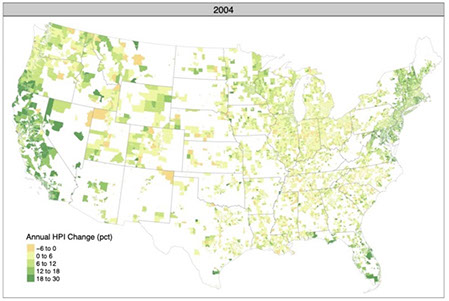

The picture above highlights one of the key contributions of this paper. I train a machine-learning algorithm using granular data (e.g. polygons of individual buildings) that represents vulnerability at the neighborhood level to hurricane damage, in order to predict the inherent long-term risk of losses in each county of coastal US states. The plots represent rankings of counties based on expected risk of hurricane losses. These are critical in my study where I compare the effectiveness and efficiency of public investments in mitigation for counties with similar inherent risk.

Public Investment in Hazard Mitigation: Effectiveness and the Role of Community Diversity

Economics of Disasters and Climate Change (forthcoming)

Abstract: I estimate the loss-reducing effect of local public investments against natural hazards with new measures of damages, weather risk, and spending for a panel of 904 US coastal counties in 2000-2020. I distinguish federally- and county-funded projects and rely on a quasi-experimental strategy, matching counties by economic development, population, and weather risk. Risk predictions come from the Random Forest learning algorithm, using granular data on resident vulnerability and severe weather frequency. Public spending on adaptation is effective -- the average high-spending county avoids a significant portion of losses -- and efficient -- $1 prevents up to $3 in losses over 20 years. The evidence suggests that federal spending is focused on high-risk areas, while local spending is effectively implemented in medium-risk counties. Finally, I show that fractionalization among residents about the priority of climate-change policy can be a limiting factor in adaptation spending. Total spending is significantly lower in areas with high diversity in policy preferences, and more so when opinions are equally split.

General Discussion: This study asks: How effective is public spending in reducing vulnerability to natural hazards? How much are communities investing out of their own budget and from federal grants? What are key driving factors? Most of the available evidence uses hypothetical weather scenarios to evaluate the effectiveness of structural measures to reduce potential losses from hurricanes. In contrast, I look at how well have past investments done over the short and medium run. I also examine the effectiveness of locally- (as opposed to federally) funded measures.

My findings indicate that public investment is effective in reducing future losses and that the spending "paid for itself". My data indicates that mid-risk counties finance measures with their own budget to a great success.

I also find that divergence in the opinions of local citizens about the priority of climate policy is an important hurdle to implementing protective measures.

The picture highlights the main insight of this paper. Within the US there are communities which are subject to repeated flooding, where losses from such events are highly expected, and there are areas where such events are very infrequent, and likely unexpected. In this study I focus on areas where extreme weather is not expected and attempt to identify if the occurrence of a hurricane serves as "new news" -- whether it shifts expectations about future risk. In particular, I focus on changes in migration and house prices.

Weather Shocks, Population, and House Prices: the Role of Expectation Revisions

Economics of Disasters and Climate Change, 2022

Abstract: I provide new evidence about the information content of weather shocks in the US coastal states, based on substantial hurricane impacts, with a quasi-experimental research design that matches counties by risk, size, and income. I examine if hurricanes represent “new news” in counties with no prior hurricanes and if expectations updating is reflected in population and house price growth. I develop a measure reflecting home- owners’ flood risk expectation based on flood insurance deductible data, which assumes that higher deductibles reveal lower flood expectations. I find that population growth declines more in counties without previous hurricanes and that this is driven by areas with lower flood-risk priors, consistent with updating when the hurricane is more likely to be “new news”. This is supported by within-county evidence that directly controls for hurricane losses and residents’ priors. I find that information updating actually increases house price growth in impacted counties with no previous hurricanes.

General Discussion: The empirical design in this paper identifies locations where the local population has different expectations about losses from severe weather. I assume that a hurricane is a surprise in areas with low expectation of losses and compare to what extent it changes population and house prices. I attribute such changes (relative to places where hurricane losses is expected) to revisions of expectations.

One novel aspect of this study is that I use flood insurance deductibles, which are chosen at will by residents, to identify locations where losses are not expected (high deductibles are the norm).

I find that "new news" reduce population growth by lowering the amount of people that migrate into affected locations. The evidence from the house market suggests that restrictions on new housing may reduce the amount of available real estate and indirectly reduce the inflow of new population.

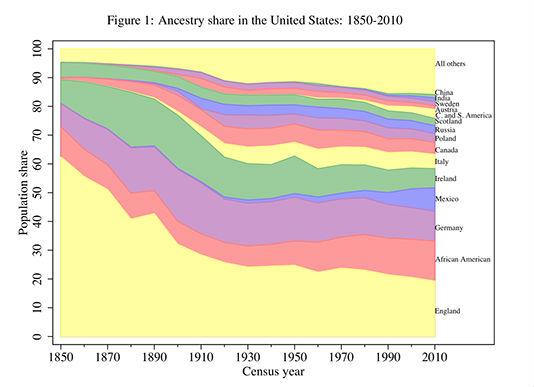

The picture shows the aggregate ancestry shares in the U.S. over time. Ancestry shares are created by summing the share in each county weighted by county population

Does it matter where you came from? Ancestry composition and economic

performance of U.S. counties, 1850 - 2010 (with Fabio Schiantarelli and Scott Fulford)

Journal of Economic Growth, 2020

Abstract: What impact will immigrants and their descendants have in their new homes in the short and long term? We develop the first measures of the country-of-ancestry composition and GDP per worker of each US county from 1850 to 2010. We show that ancestry groups have different impacts on county productivity. Groups from countries with higher economic development, with cultural traits that favor cooperation, and with a long history of a centralized state have a greater positive impact on county GDP. Origin diversity is positively related to county GDP, while diversity in origin culture or economic development is negatively related.

General Discussion: Our work shows unequivocally that groups have different economic impacts and these impacts are closely related to characteristics in the origin country. We show that ancestry groups have different effects on county GDP per worker, even after after we control for county-specific fixed effects, race, and other observables. The effects of different groups are correlated with characteristics of the country of origin. The relationship between origin GDP and county GDP shows that there must be be something important for economic development that is transportable and in- heritable. We examine possible origin characteristics that might explain the relationship. What appears to matter most for local economic development are cultural characteristics that capture the ability of people to productively interact with others.

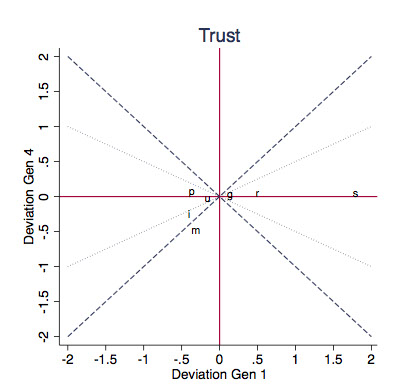

This picture is form the paper. We compute convergence for each of the attitudes in our sample by comparing the ratio of the deviation from the norm in the first generation immigrant from a particular country to the deviation from the norm in the forth generation of an immigrant from the same country. Here we plot on the x-axis the deviation in the first generation and on the y-axis the deviation in the forth generation.

Culture: Persistence and Evolution (with Francesco Giavazzi and Fabio Schiantarelli)

Journal of Economic Growth, 2019

Abstract: This paper documents the speed of evolution (or lack thereof) of a range of values and beliefs of different generations of US immigrants, and interprets the evidence in the light of a model of socialization and identity choice. Convergence to the norm differs greatly across cultural attitudes. Moreover, results obtained studying higher generation immigrants differ from those found when the analysis is limited to the second generation and imply a lesser degree of persistence than previously thought. Persistence is also country specific, in the sense that the country of origin of one’s ancestors matters for the pattern of generational convergence.

General Discussion: We find that the beliefs that shape trust of second generation immigrants towards other members of society remain different from the prevailing US norm and still bear strongly the mark of the country of origin. However, such differences become smaller when one considers fourth or higher-generation immigrants. We find, for instance, that attitudes towards cooperation (the trustworthiness, helpfulness and fairness of others) display the highest degree of convergence by the fourth generation, as successive generations adapt to the norms of the new society in which they live. Attitudes towards politics and the role of government, sexual morality and abortion exhibit the lowest degree of convergence, followed by religious attitudes. Attitudes towards gender roles occupy an intermediate position, with attitudes towards the role of women in the labor market converging faster than those related to the role of women in politics. Family attitudes also display on average an intermediate level of convergence, but there is substantial heterogeneity among them.

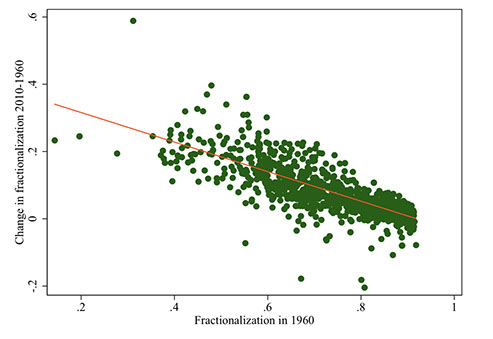

This is a key figure from the paper which highlights the dynamics of ethnic diversity (fractionalization) across the US. We show that counties that were relatively more homogeneous in 1960 experienced the biggest increase in diversity as they continue to catch up with the already-more diverse areas. This diffusion of ethnic diversity can create hurdles for local public spending as different groups argue over appropriate priorities. We explore this question in the rest of the paper.

Ancestry Diversity and Local Public Spending in the US since 1870 (with Scott Fulford and Fabio Schiantarelli)

Working Paper (under review)

Abstract: We study the changing country-of-ancestry composition of U.S. counties since 1870 and its relationship with local public spending on education and the police. We show that ancestry diversity increased rapidly from 1870 to 1930 and at a slower pace after 1960. The areas experiencing the fastest recent increase in diversity were the least diverse in 1960. We examine how different diversity measures relate to local public spending. Increases in origin-country cultural or GDP weighted fictionalization are associated with reductions in education expenditure. Increases in racial fractionalization, instead, are associated with increases in education expenditures and decreases in police expenditures.

General Discussion: The complex mosaic of ancestry in the U.S. has changed profoundly over time and it is still evolving as new migrants enter and people move internally. We use the quantitative mapping of U.S. counties’ ancestry distribution from 1870 to 2010 to provide the first complete description of U.S diversity across time and space. Both immigration flows and internal movements of population have contributed to an increasingly widespread experience of diversity.

We find a robustly negative and significant association between cultural fractionalization and resources devoted to education in all our panel. This is generally consistent with stories that emphasize difficulty agreeing on investment in public goods in a more diverse environment.

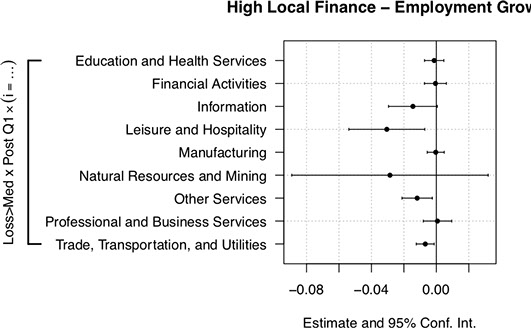

The analysis in my paper helps uncover which industries benefit from access to national lenders following a severe disaster and which can benefit from local lenders. Firms in the Leisure and Hospitality, and Trade, Transportation, and Utilities industries recover within the first quarter after a disaster in counties where national lenders are more prevalent. In contrast, the figure above shows that firms operating in these industries tend to experience a pronounced reduction in employment growth when local lenders are more prevalent. Sectors which rely on local foot traffic and discretionary spending are at a higher risk of failure after losses from severe weather.

The Economic Impact of Hurricanes in the US: Does Local Finance Matter?

Working Paper (under review)

Abstract: I study the employment impact of natural hazards and the role of the banking industry in improving resilience. I assemble a novel dataset of losses in US coastal state counties during 1998-2019. My analysis incorporates weather risk and addresses concerns that the local banking structure is endogenous with respect to the likelihood of disasters. Local finance exacerbates the disaster-driven job contractions and limits resilience in counties with: i) higher risk -- where overall damage is higher; ii) higher income -- where the local population may rely more on private credit; ii) more risky industry sectors -- where local lenders can suffer higher loan losses. Diversified, non-local banks are not subject to significant losses and increase lending post disaster, which can explain why counties with more non-local lenders have faster growth and improved resilience.

General Discussion:

This paper has three sets of results:

A: The average hurricane causes about 0.33% reduction in county employment 3 months after landfall, with no recovery in the 3-6 month horizon. This result is based on comparing counties with similar risk and economic development. The estimated effect is much bigger when risk and development are not taken into account.

B: The employment shock is prevalent in counties where banks are geographically focused on a handful of markets. In these areas, industries that are vulnerable to hurricane impacts suffer biggest job losses compared to places served by geographically diversified lenders.

C: Bank analysis shows that geographically focused banks experience loan losses, leading to charge-offs. As a result, such lenders limit credit expansion after disasters. In contrast, diversified lenders expand credit and suffer minimal loan losses.

How Much of New Bank Lending is in the Flood zone?

Preliminary Work

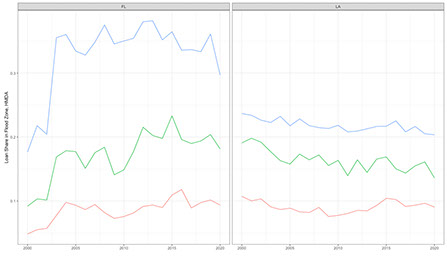

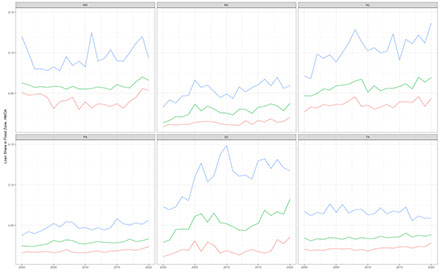

General Discussion: I use mortgage and small business lending geographic data, combined with spatial flood zone and building footprint information to measure how much credit is originated in areas with high flood risk. I focus on flood zones in the Atlantic states and map the lending by the entire universe of banks reporting in the HMDA and CRA datasets. I find that the median bank headquartered in Florida and Louisiana originates almost 20% of its overall mortgage lending in areas with high flood risk. Risk exposure for the median bank is steady during 2000-2020 but banks in NJ and SC are increasing lending in high-risk areas.

Results for small business lending contrast with those for mortgages. While banks in FL and LA lend the most to businesses in areas with high risk, the share has been declining.

The figures above plot the time series of quartiles of the proportion of new mortgage lending in areas with high risk of flooding. Banks are groups according to the state of the headquarter. The eight states above have the highest risk exposure.

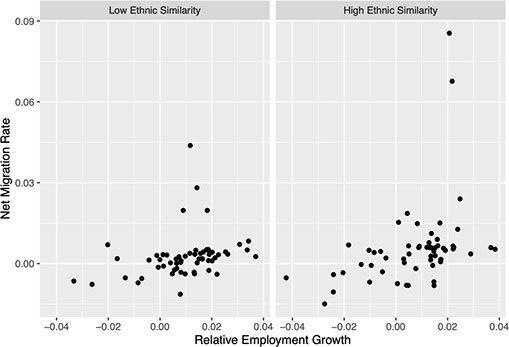

The figure provides some evidence that faster relative employment growth between two counties is associated with increased net in-migration -- both plots show a positive association between the two. More importantly, this relationship is much stronger when the two counties have higher ethnic similarity -- the right panel plots counties with above-median ethnic similarity.

Employment Opportunities and Migration in the US: the Role of Ethnic Similarity

Preliminary Work

General Discussion: I examine the importance of job opportunities for cross-county migration and whether social connectedness between counties promotes job-related migration. I use a sample of annual county-pair net migration and evaluate the migration response to above-median employment growth based on differences in ethnic similarity with a difference-in-difference specification. I instrument employment growth with standard Bartik shocks and find that the unconditional response is positive but fairly weak. However, migration between counties with high social connectedness based on high ethnic similarity is twice as high as the baseline. This provide evidence that more socially connected counties can draw in higher inflows of workers when job opportunities increase.

Local Competition and Systemic Lenders (Jun Ma and Jiacheng Liang)

Preliminary Work

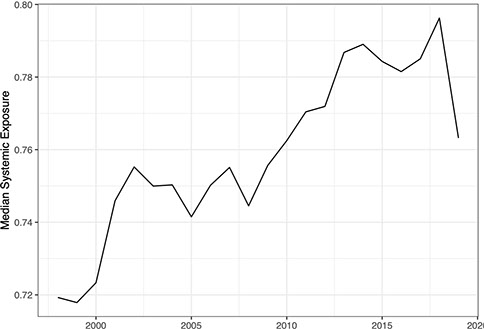

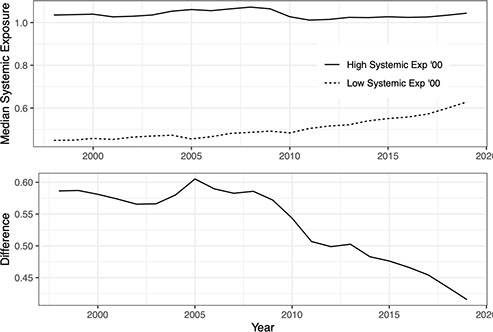

General Discussion: We use a Dynamic Factor Model with time-varying loading parameters and stochastic volatility in order to identify the exposure of 100 Bank-holding Companies (BHCs) to aggregate shocks. We establish some empirical regularities about the evolution of exposure to common factors in the banking industry has evolved during 1996-2020. We find that during the period following the financial crisis there was a pronounced increase in macro exposure for the median bank. This increase is about 8% -- starting from 0.74 in 2009 to a high of about 0.80 in 2019. There is clear evidence that the increase in macro exposure is more prominent for banks whose business practice makes them less exposed to aggregate shocks. Results from difference-in-difference specifications suggest that the increase in macro exposure is associated with slower asset growth and higher concentration of assets in loans.

The top figure plots the exposure of earning to systemic (economy-level) shocks of the median bank holding company (among the top 100 banks). We see that banks have become significantly more exposed to economy-wide factors (0.72 in 2000 vs 0.80 in 2019). The bottom panel divides banks into low/high exposure as of 2000. The evidence suggests that lenders with lower exposure to systemic factors are the main driver behind increasing systemic-risk exposure in the bank industry.

CV:

Ivan Petkov

Contact:

Address:

Northeastern University

Department of Economics

316 Lake Hall

Boston, MA 02115

Telephone: +1 (857) 869 5353

Thank you for visiting my website!

Copyright 2015. All Rights Reserved